Tag: SCR

Solvency Capital Requirement – the higher of the two capital requirements under Solvency II.

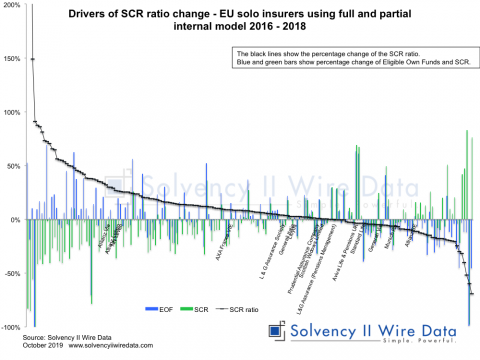

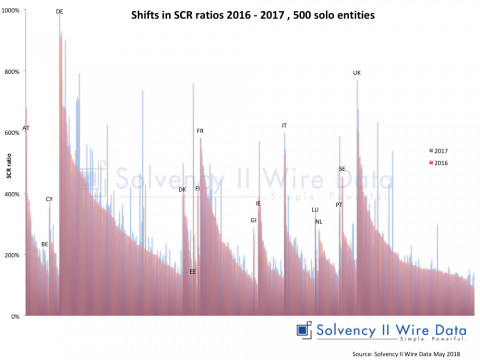

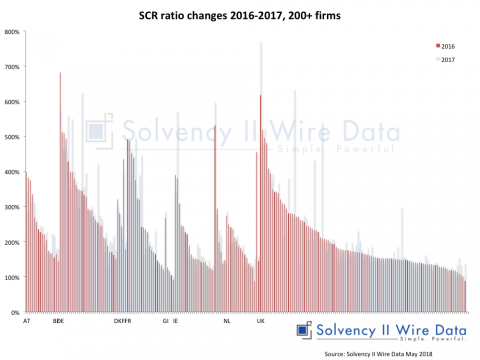

Drivers of Solvency II SCR ratio change across Europe 2016 – 2018

October 23, 2019

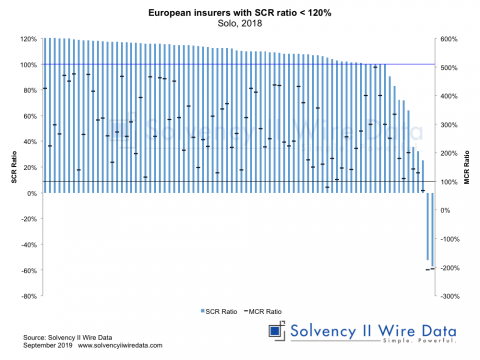

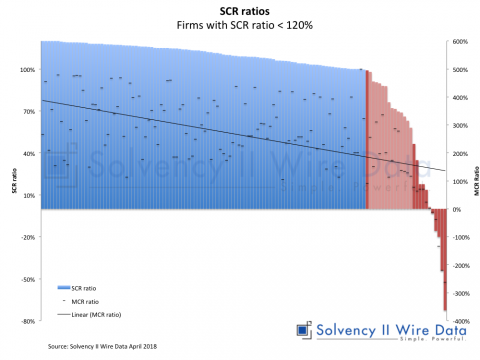

Insight into the lower end of the European insurance market

September 2, 2019

Tracking shifts in counterparty default risk

September 25, 2018

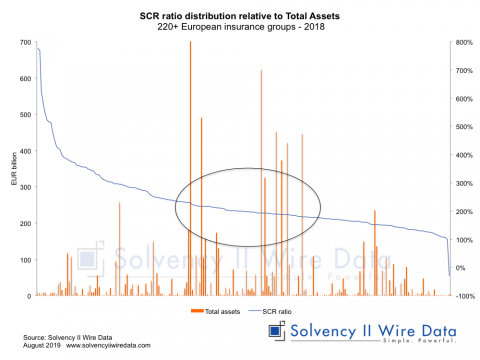

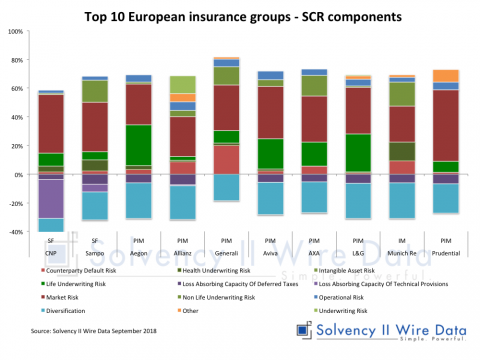

SCR components comparison of European insurance groups

September 11, 2018

Deconstructing Internal Model SCR components

January 24, 2018

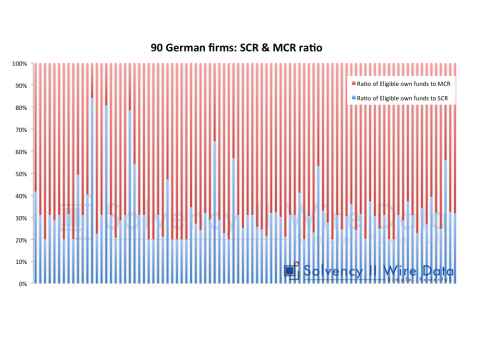

MCR shock – testing the strength of the SCR coverage ratio

October 30, 2017

99 insurers sailing close to the wind

October 24, 2017

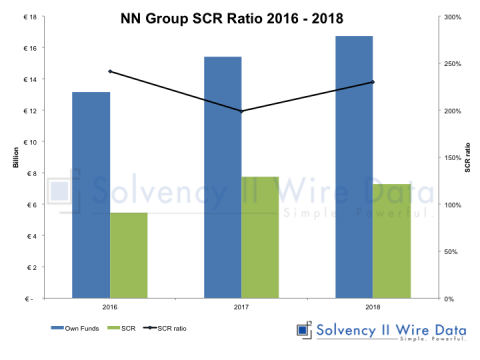

Topsy-turvy SCR ratios

July 4, 2017

Three-chart ‘peek’ into QRTs from Luxembourg

June 15, 2017