Interviews with regulators

Transitions to a Solvency II world: Part 2

Part 1 of this extensive and first interview with Nathalie Berger, Head of the Insurance and Pensions Unit at the European Commission, looked at the impact...

Transitions to a Solvency II world: Part 1

Solvency II Wire about the Commission’s shifting priorities and the challenges of implementing and monitoring Solvency II. Nathalie Berger was appointed to head the Insurance...

Barnier on Omnibus II

Michel Barnier, European Commissioner for Internal Market and Services, responds to written questions from Gideon Benari, Editor of Solvency II Wire about the Omnibus II...

Transparency and legacy

The final part of an extensive interview Carlos Montalvo, Executive Director of EIOPA, in which he talks about the challenges of reporting, look-through and contemplates the future...

In depth analysis

The ORSA must be part of the business. Clare Bousfield, Chief Financial Officer, Aegon UK, describes how to derive value from the ORSA by...

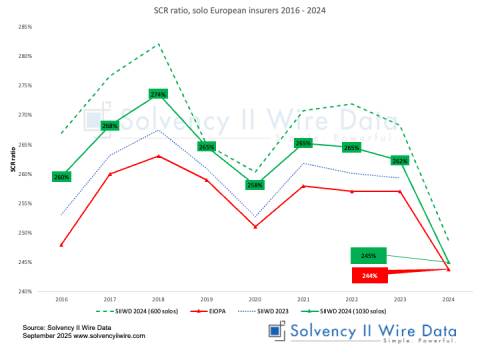

EIOPA Solvency II Insurance statistics published this week confirm market analysis conducted by Solvency II Wire Data predicting growth of European insurance market...

Recent Posts

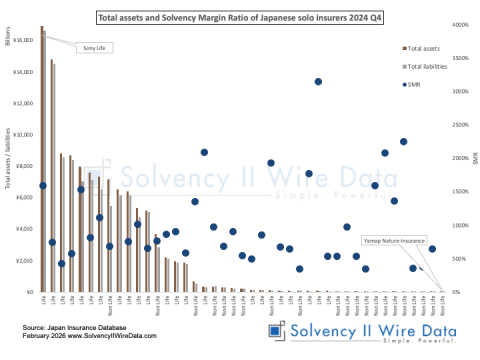

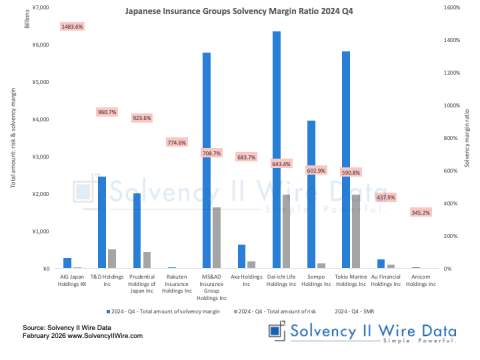

Distribution of Solvency Margin Ratios in Japan’s insurance market

February 27, 2026

Japan Economic Solvency Ratio (ESR) – watch out for the drop

February 13, 2026

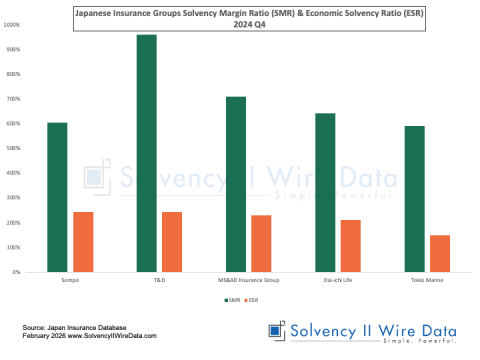

Japanese Insurance Groups – Solvency Margin Ratio 2024 Q4

February 8, 2026

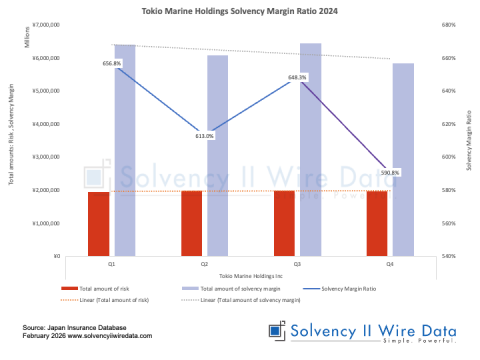

Tokio Marine Holdings Solvency Margin Ratio 2024

February 2, 2026

Japanese influence in Bermuda’s insurance landscape

December 31, 2025

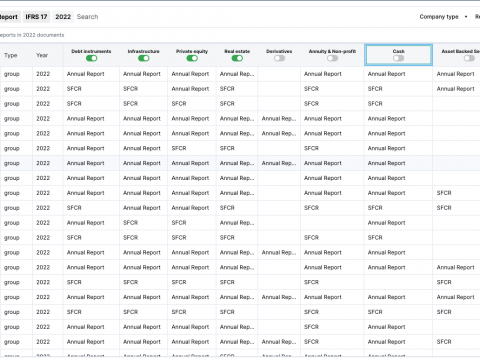

Solvency II Wire Data – BLUE

December 21, 2025

Insurance private credit: a new 200-year-old idea

December 13, 2025

Tier capital (under)use by Bermuda’s insurance sector

November 27, 2025

Geopolitical risk impact on insurers

November 9, 2025

Webinar: UK Life Insurance Market Resilience – Trend or Anomaly?

November 4, 2025

Use of the risk margin in the Bermuda insurance market

November 2, 2025

Solvency II figures signal Premier Insurance failure

October 17, 2025

Exploring the state of the insurance market

September 7, 2025

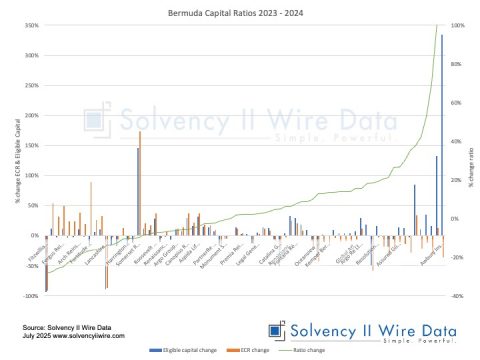

Bermuda Capital Ratios 2024

July 9, 2025

Czech Republic insurance market analysis

June 11, 2025

Solvency II group reporting annual statistics 2024

June 2, 2025