Author: Gideon Benari

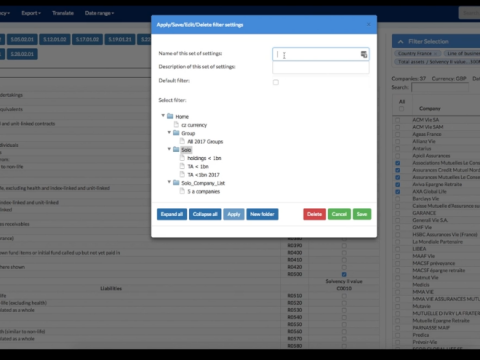

Filter Presets

May 25, 2018

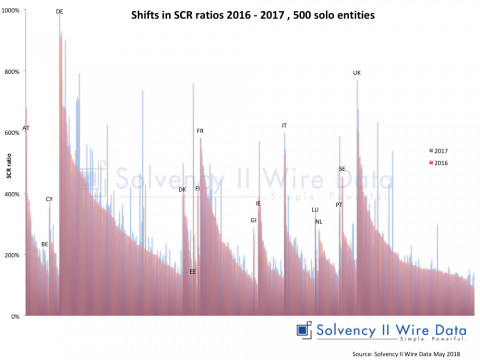

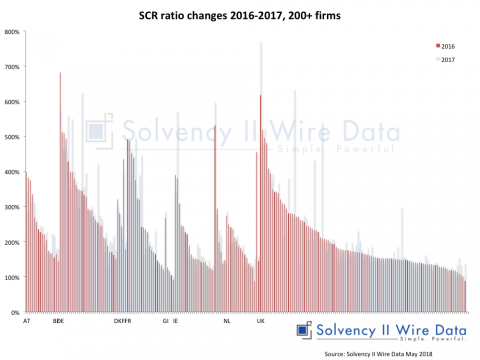

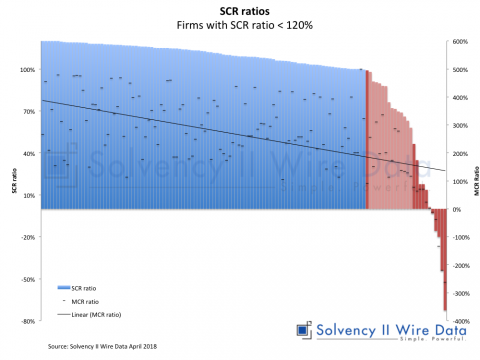

Reinsurance and the Solvency II public disclosures

April 24, 2018

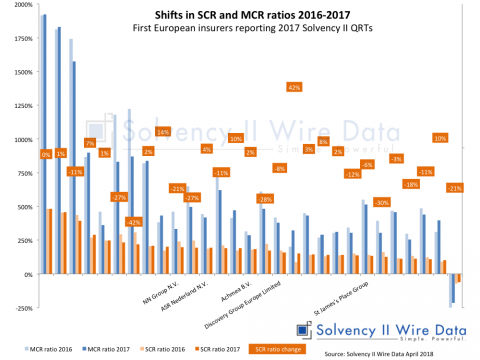

NN Group published SFCR and QRT for 2017

April 10, 2018

SFCR comparison tools – Solvency II Wire Data

April 3, 2018

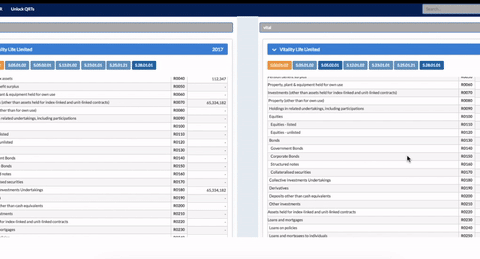

Side by Side View upgrade

March 27, 2018