The Solvency II SCR ratio is becoming on of the dominant measures for assessing the financial strength of European insurance companies. Together with the MCR ratio (Minimum Capital Requirement), the lower of the two regulatory capital requirements insurers have to meet, it forms the basis for analysis and comparison between companies across the market.

Given the complexity of the underlying data points that make up the ratios, the SCR ratio and MCR ratio are often used as the launching point for further analysis.

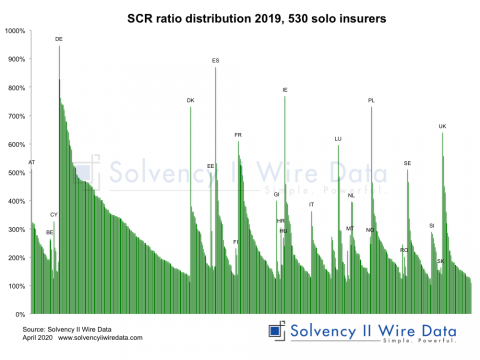

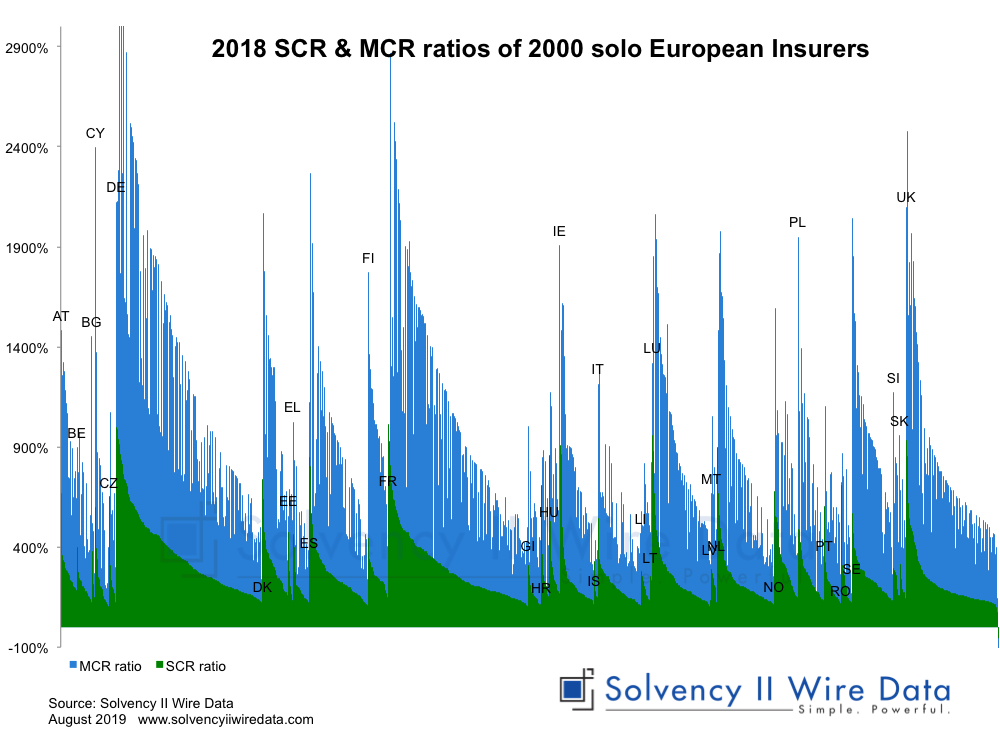

Solvency coverage of solo insurers

The chart below below shows the SCR ratio and MCR ratio distribution of 2,000+ solo European insurers, by country in 2018.

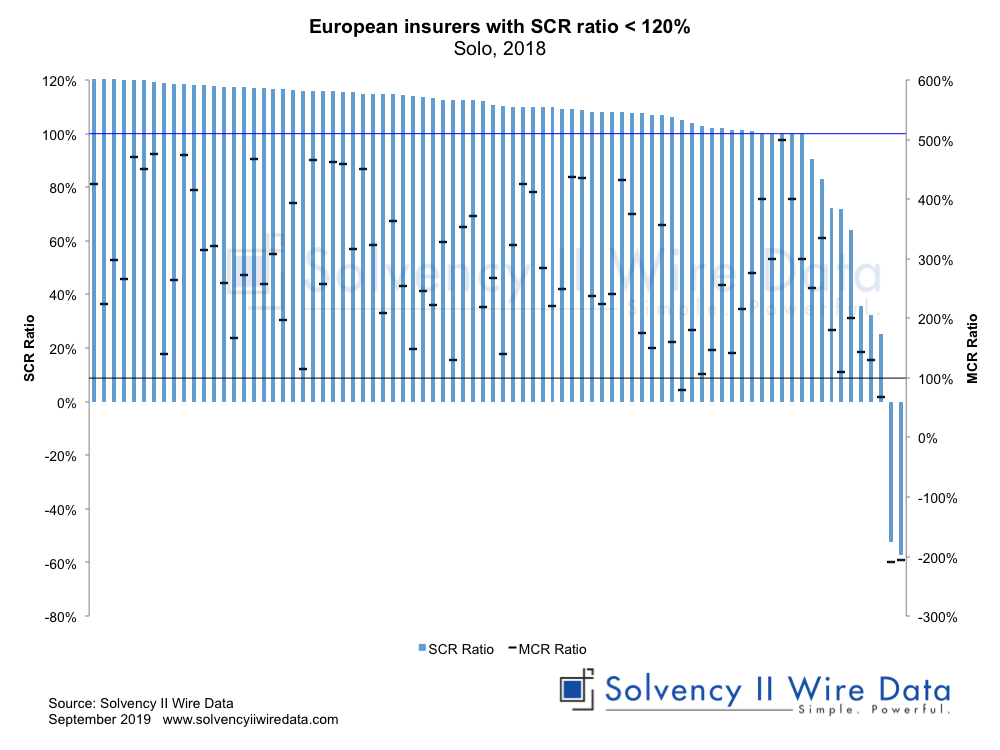

Figures at the lower end of the market reveal that there are 81 insurers with an SCR ratio of less than 120% (bars on left axis). Of these, 10 firms have breached the SCR ratio (less than 100%, blue line), which triggers regulatory intervention.

The data also shows that four of the firms have breached their MCR ratio (right axis, black line).

In 2017 there were 89 firms with similar SCR ratios, 6 of which breached their MCR ratio. Both years are a significant improvement on the first reporting year (2016) which saw 153 firms with an SCR ratio of less than 120%, 33 of which breached the ratio and 15 that breached their MCR ratio.

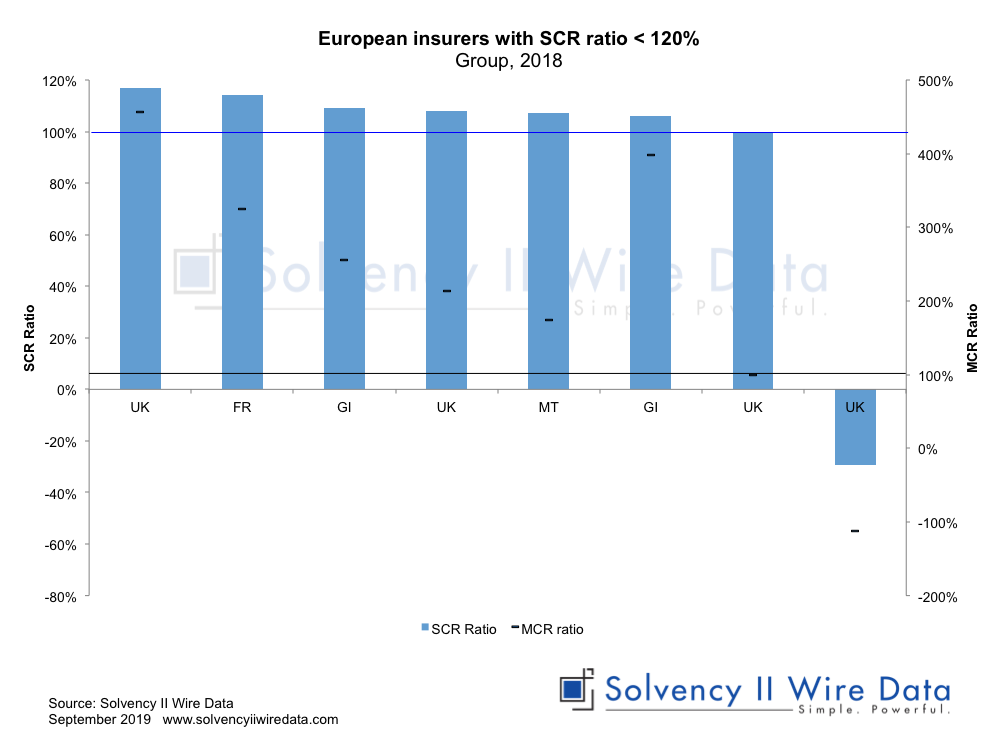

European insurance groups with low SCR coverage ratios

Analysis of the Solvency II coverage ratios for European insurance groups in 2018 so far, reveals 8 groups with an SCR ratio below 120%.

One group has an SCR and MCR ratio of 100% and another breached both its ratios.

The data for this analysis was provided by Solvency II Wire Data.

Market coverage figures are subject to change as some companies have not yet published Solvency II public disclosures.

The Full set of QRTs for all data in charts is available to Solvency II Wire Data subscribers. Click here to find out more.

Solvency II Wire Data collects all available public QRT templates for group and solo.

Group templates available on Solvency II Wire Data

S.02.01 Balance sheet

S.05.01 Premiums, claims and expenses Life & Non-life

S.05.02 Premiums, claims and expenses by country Life & Non-Life

S.22.01 Impact of long term guarantees and transitional measures

S.23.01 Own funds

S.25.01 SCR Standard formula

S.25.02 SCR Standard Formula Partial Intern ModelS

S.25.03 SCR Standard Formula Intern Model

S.32.01 Undertakings in the scope of the group