Solvency II and Basel III united in a (covered) bond

Record level of covered bond issuance may quench insurers’ thirst for long-dated debt. The FT reports that the large amounts of covered bonds being issued by banks to comply with Basel III may offer one of the most efficient ways of investing in long term bonds under Solvency II. This may help reconcile the mismatch of supply and demand for long dated debt between banks and insurers.

[caption id="attachment_1357" align="alignleft" width="132"] European covered bond issuance[/caption]

European covered bond issuance has returned to pre-crisis levels (see chart left), while UK sterling issuance in 2011 has already reached close to £6 billion, the FT reports. Insurers and pension funds hold 18% of UK regulated covered bonds (see chart below).

[caption id="attachment_1358" align="alignright" width="227"]

European covered bond issuance[/caption]

European covered bond issuance has returned to pre-crisis levels (see chart left), while UK sterling issuance in 2011 has already reached close to £6 billion, the FT reports. Insurers and pension funds hold 18% of UK regulated covered bonds (see chart below).

[caption id="attachment_1358" align="alignright" width="227"] Investors in regulated covered bonds[/caption]

However, covered bonds have come under scrutiny. The Cut (FT Alphaville blog) noted in March that a US House of Representatives bill may dilute the strength of US covered bonds. “While European banks have used covered bonds’ conservatively managed pools of loans to lower borrowing costs, most loans are high-quality mortgages. US proposals would add student or car loans that could attract different investors drawn to risk rather than stability.”

Richard Ryan, senior credit fund manager at M&G, told the FT there was an issue with the transparency of some of these ultra safe US covered bonds. “The worst ones label themselves ‘covered’ but offer a rollercoaster ride rather than disclosure or protection. Chasing their yield and piling in with no analytical backup is foolhardy,” he said.

In April the FSA published a Review of the UK’s regulatory framework for covered bonds.

Investors in regulated covered bonds[/caption]

However, covered bonds have come under scrutiny. The Cut (FT Alphaville blog) noted in March that a US House of Representatives bill may dilute the strength of US covered bonds. “While European banks have used covered bonds’ conservatively managed pools of loans to lower borrowing costs, most loans are high-quality mortgages. US proposals would add student or car loans that could attract different investors drawn to risk rather than stability.”

Richard Ryan, senior credit fund manager at M&G, told the FT there was an issue with the transparency of some of these ultra safe US covered bonds. “The worst ones label themselves ‘covered’ but offer a rollercoaster ride rather than disclosure or protection. Chasing their yield and piling in with no analytical backup is foolhardy,” he said.

In April the FSA published a Review of the UK’s regulatory framework for covered bonds.

Proportionality unease for captives

Captive insurers are unclear how Solvency II will affect their capital and reporting requirements. Business Insurance reports that the industry is still seeking clarification on how proportionality will affect captive insurers. The proportionality principle aims to treat each firm in a way that will not create an unnecessary regulatory burden – ensuring regulators aren’t using a sledgehammer to crack a nut. Although primarily aimed at small and medium size insurers, proportionality also applies to specialist insurers. The Directive text states, “This Directive should not be too burdensome for insurance undertakings that specialise in providing specific types of insurance or services to specific customer segments, and it should recognise that specialising in this way can be a valuable tool for efficiently and effectively managing risk.” But it is unclear how the principle will be applied to captives. According to Carlos Wong-Fupuy, analyst at A.M. Best, and one of the authors of a recent report on the subject, a captive will be assessed on the “complexity of risks underwritten within a captive rather than its size.” The captive industry is also lobbying for looser reporting requirements. Pierre Sonigo, general secretary, Federation of European Risk Management Association (FERMA), explained that “since most captives do not write insurance for the general public, they should not be required to disclose as much information as traditional insurance companies writing third-party business.” Business Insurance also looks at how Solvency II may increase the capital requirements of captives, prompting some firms to reconsider the viability of having a captive insurer.Solvency II: far-reaching impact on credit ratings

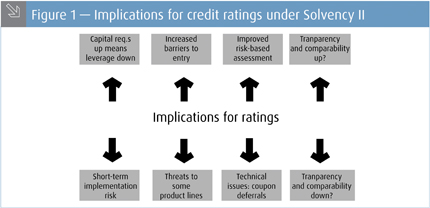

[caption id="attachment_1379" align="alignright" width="258"] Implications for credit ratings under Solvency II SOURCE: The Actuary[/caption]

Solvency II will have a mixed effect on the credit ratings of insurers. A feature in The Actuary discusses how adjusting the asset portfolio to make the most of the regulation’s capital charges could affect the ratings of some firms.

The change in credit rating will also depend on how each firm handles the transition to Solvency II, as well as new levels of exposure to risk.

“Solvency II could transform the insurance landscape with some fundamental shifts to a lower-risk product mix, more cautious investment strategy and, for certain products, higher premiums,” according to the authors.

The chart shows how some of the drivers could affect credit ratings.

Implications for credit ratings under Solvency II SOURCE: The Actuary[/caption]

Solvency II will have a mixed effect on the credit ratings of insurers. A feature in The Actuary discusses how adjusting the asset portfolio to make the most of the regulation’s capital charges could affect the ratings of some firms.

The change in credit rating will also depend on how each firm handles the transition to Solvency II, as well as new levels of exposure to risk.

“Solvency II could transform the insurance landscape with some fundamental shifts to a lower-risk product mix, more cautious investment strategy and, for certain products, higher premiums,” according to the authors.

The chart shows how some of the drivers could affect credit ratings.