Brexit and the covid-19 pandemic will likely have a lasting impact on the European insurance industry in 2021 and beyond. One area to watch is how they affect the amount of cross-border business written by European insurers within the EEA.

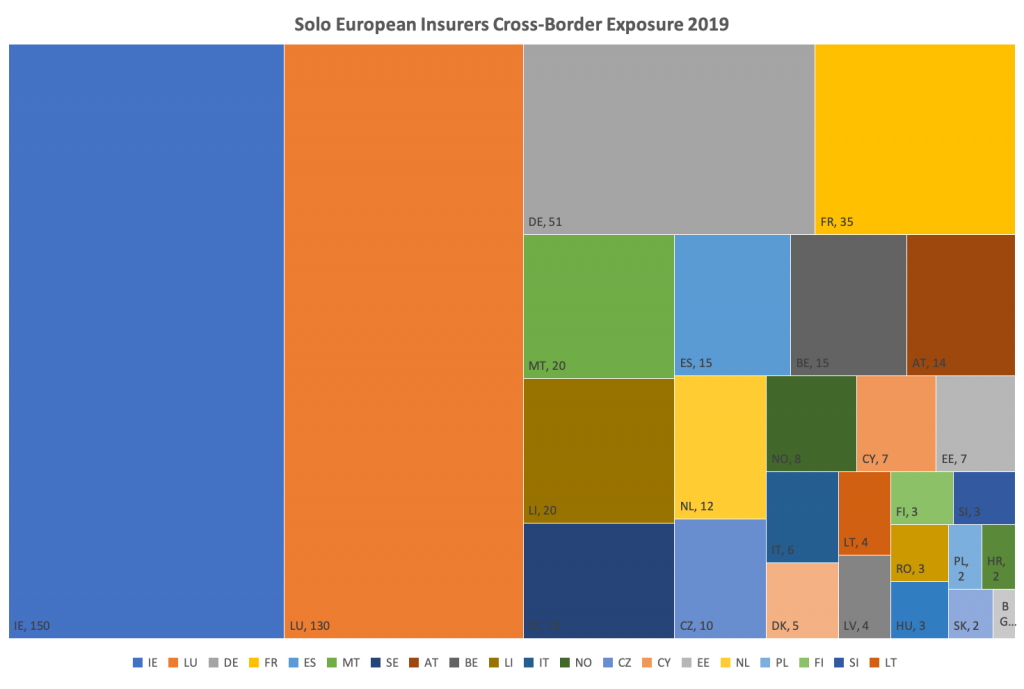

Analysis conducted by Solvency II Wire Data based on the Solvency II public disclosures reveals that in 2019 Ireland and Luxembourg had by far the largest number of insurers writing cross-border business within the EEA (150 and 130 entities respectively).

The chart shows the number of solo entities per country that have cross-border exposure based on information published in the Solvency II QRT template S.05.02 – Premiums, Claims and Expenses by Country. The data was compiled and aggregated using the Solvency II Wire Data S0502 Tool.

553 solo entities representing EUR 2.4 trillion total assets under management were used in the analysis.

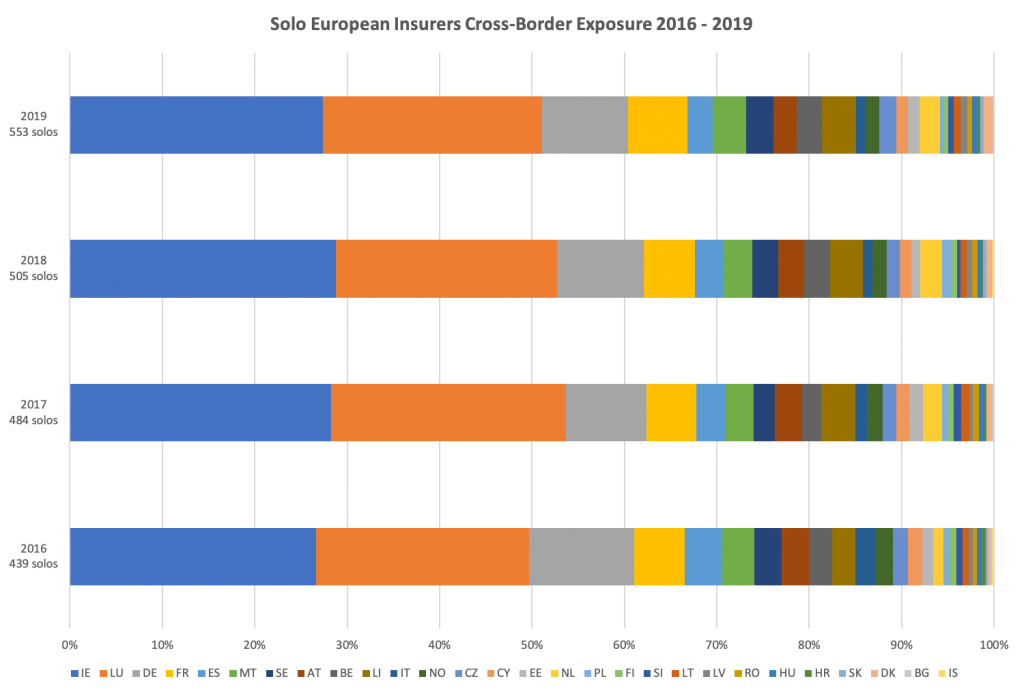

The S.05.02 data is in places incomplete due to the poor quality of publication by some of the reporting entities. Despite these limitations, the figures remain relatively consistent over the four years of Solvency II disclosures.

The number of solo entities engaging in cross-border activity continues to rise; from 439 in 2016 to 553 in 2019. In December 2020 EIOPA published peer review analysis on supervisory collaboration in relation to insurance cross-border activities.

Solvency II Wire Data collects all available public QRT templates for group and solo.

QRT templates available on Solvency II Wire Data

S.02.01 Balance sheet

S.05.01 Premiums, claims and expenses Life & Non-life

S.05.02 Premiums, claims and expenses by country Life & Non-Life

S.12.01 Life and Health SLT Technical Provisions

S.17.01 Non-life Technical Provisions

S.19.01 Non-life Insurance Claims Information

S.22.01 Impact of long term guarantees and transitional measures

S.23.01 Own funds

S.25.01 SCR Standard formula

S.25.02 SCR Standard Formula Partial Intern Models

S.25.03 SCR Standard Formula Intern Model

S.32.01 Undertakings in the scope of the group